What Factors Determine a Region’s Housing Affordability?

Did you know the average rent for a single-family home in New York City is $1,481 a month? In other words, rent takes up over 28% of the per-capita yearly income in New York City. It’s no wonder countless people rely on home loans in New York!

In contrast, it costs just $530 per month for an identical home in San Juan, Puerto Rico. While New York City offers a much better quality of living than San Juan, is it worth paying almost three times as much in rent? What factors contribute to the rising cost of housing in places like New York City?

If you’re pondering the answers to these questions, you’re in the right place! Here’s a summary of the six biggest factors determining a region’s housing affordability.

1. Population

One of the biggest factors impacting housing affordability in a region is the number of people living there. If a region’s population grows, housing demand increases because more people require a place to stay. This causes house prices to shoot up if there aren’t enough houses to accommodate everyone.

The extent to which house prices increase due to an increase in a region’s population depends on housing availability. House prices increase more frequently in places like New York City because there’s limited construction space for new housing. On the other hand, spending on residential construction is highest in southeastern states like Alabama, where there’s ample space to build new properties.

2. Average Household Income

Picture this. You’re looking to buy a new house, and your budget is $500,000. However, you get promoted at work and get a $10,000 bump in your yearly income. Would you be tempted to increase your house budget? Chances are, the answer is yes!

It’s common for people to seek better and more expensive housing when their incomes rise. But have you ever thought about what that does to the price of housing? If people’s ability to afford housing goes up, sellers raise their asking prices. In other words, housing affordability in a region goes down when household incomes go up!

3. Taxes

Imagine finding your dream home for sale, only to realize it’s out of your budget because of property taxes. We wouldn’t blame you for feeling frustrated! Unfortunately, property taxes are mandatory in most states and vary depending on which state you’re in.

The total price of a house consists of the seller’s asking price plus a property tax. Therefore, housing affordability in places like New Hampshire is low because it has some of the highest property taxes in the country!

4. Crime Rates

If you asked the average joe whether they’d be comfortable buying a home in a crime-ridden neighborhood, chances are they’d say no!

Unfortunately, numerous low-income households have no choice but to buy housing in crime-infested neighborhoods because it’s affordable. In other words, housing affordability is higher in regions with high crime rates. However, there are instances where high-income earners move to a region despite the high crime rate in an effort to rebuild it. This is known as gentrification—and it leads to housing affordability going down as the region undergoes development.

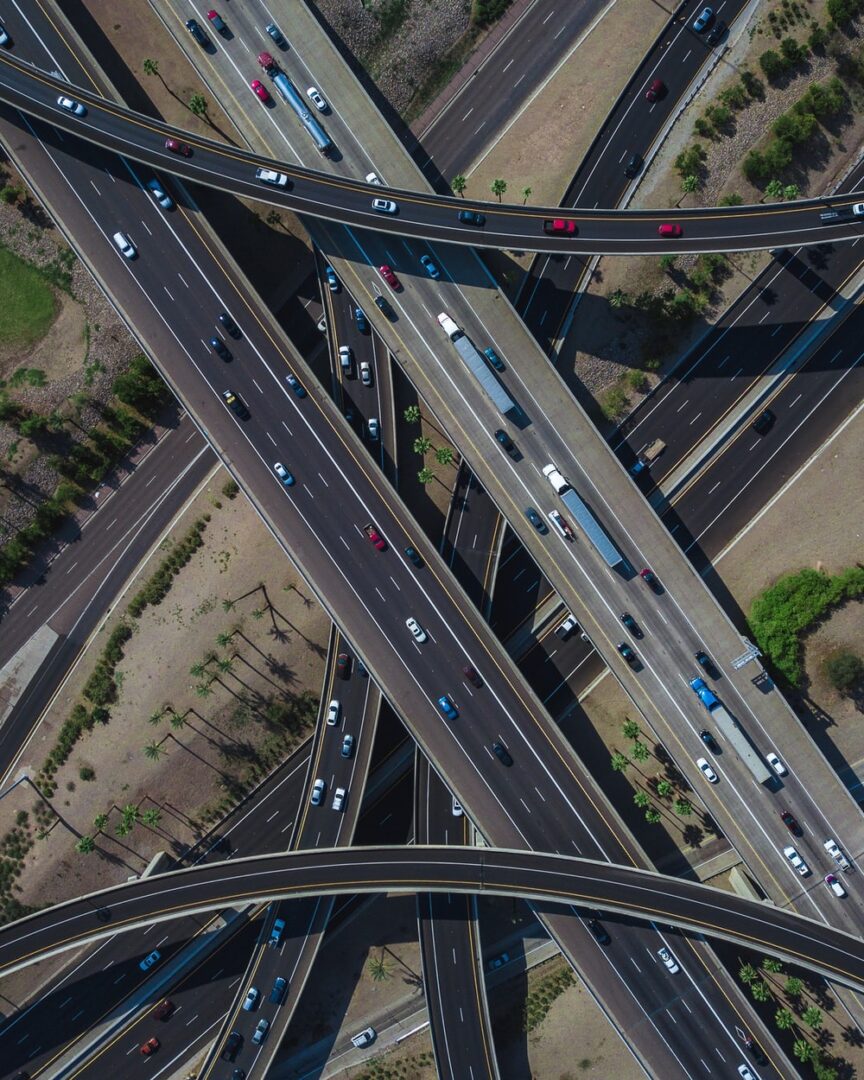

5. Infrastructure

Have you ever wondered why the demand for housing in well-developed places like New York City is so high? It’s because their infrastructure is superior to other cities!

Infrastructure refers to the various physical systems that keep a city functional such as roads, drains, and traffic lights. It also refers to services that raise the region’s standard of living, such as public transport and internet connectivity. Cities with better infrastructure attract more residents, which generates housing demand, causing housing prices to rise and housing affordability to fall.

6. Consumer Trends

Do you remember the hipster phenomenon that took over the country ten years ago? Thousands of young Americans—many of whom were prospective homebuyers—began dressing in retro clothes and moving in large numbers to cities like San Francisco.

While the hipster trend has largely died down, house prices remain high in these cities because they continue to be popular destinations for people who love countercultures. This is why consumer trends are one of the biggest factors affecting a region’s housing affordability. If it becomes trendy to move to a particular region, housing demand will skyrocket, and affordability will go down.

There are also instances when it becomes trendy to move away from a region. For instance, there were numerous cases of people moving away from their cities at the height of the COVID-19 pandemic because they felt too restricted. This trend caused housing demand and prices to fall in their cities. In contrast, housing demand in places like Florida rose during the COVID-19 pandemic because people saw it as one of the last states willing to uphold personal freedoms.

Are you struggling to buy a house in New York because of its notoriously low housing affordability? If so, our team of expert mortgage consultants at Atlantic Home Capital is ready to help! We offer an array of mortgage loans to help make housing more affordable such as VA loans for military personnel and modular mortgage loans if you’re interested in purchasing a prefabricated home. We also offer refinancing services to improve our clients’ mortgage terms.

Don’t let housing affordability come in the way of landing your dream home. Get in touch with us today and let our team of seasoned mortgage lenders help you apply for home loans in New York!