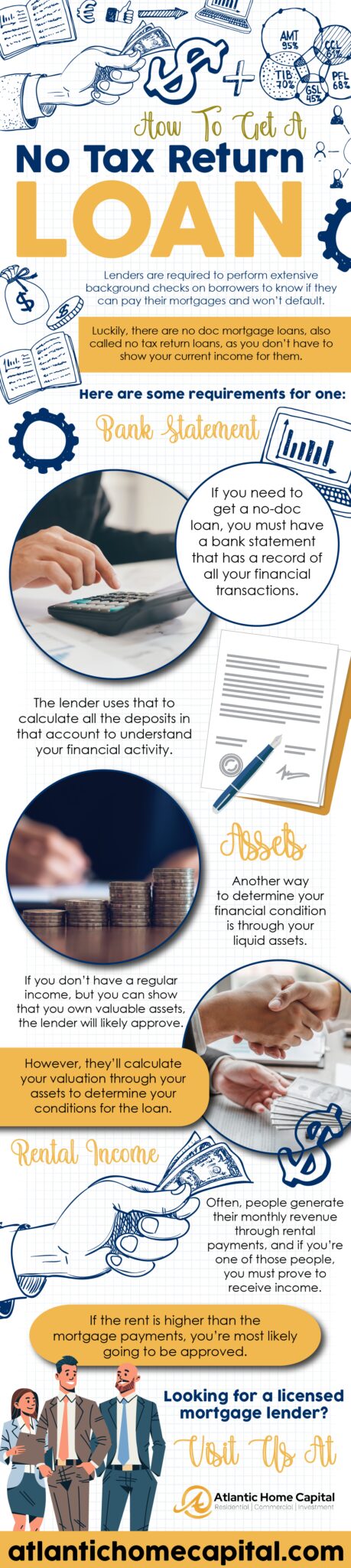

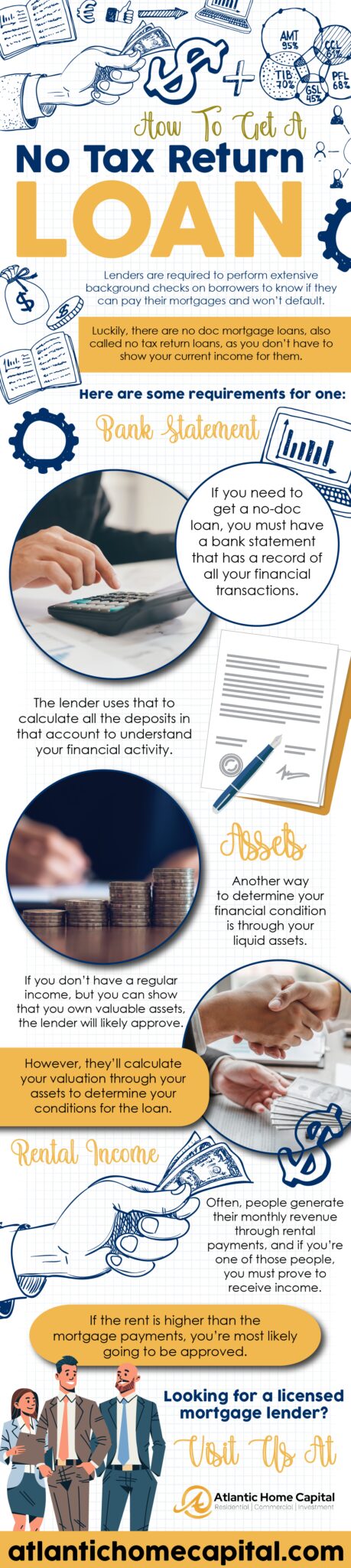

How To Get A No Tax Return Loan

Lenders are required to perform extensive background checks on borrowers to know if they can pay their mortgages and won’t default.

Lenders are required to perform extensive background checks on borrowers to know if they can pay their mortgages and won’t default.