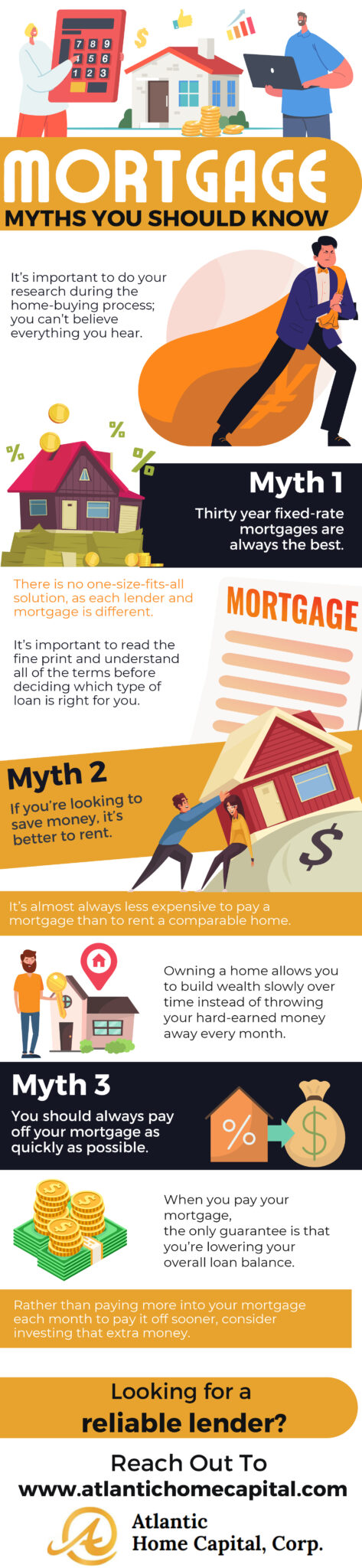

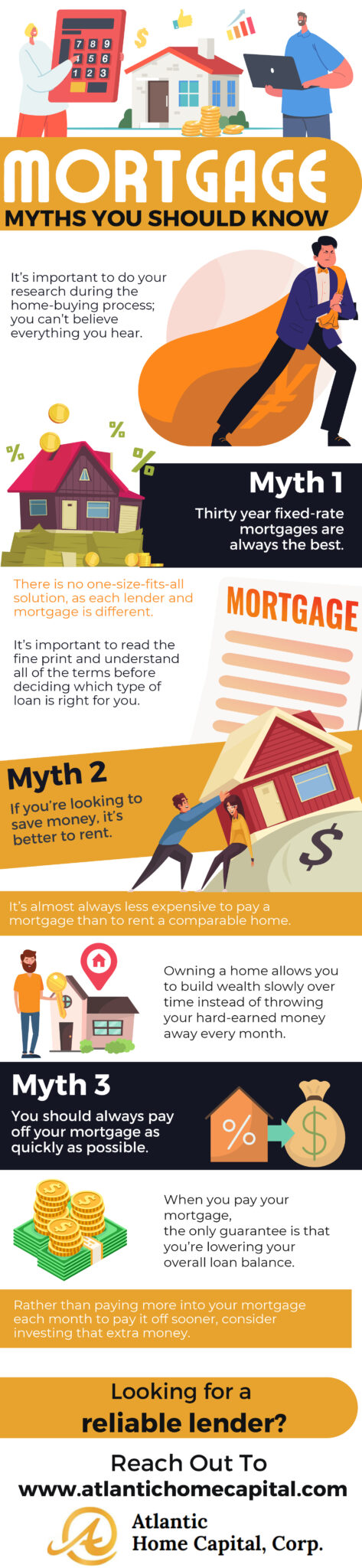

Mortgage MYTHS You Should Know

It’s important to do your research during the home-buying process; you can’t believe everything you hear. Rather than paying more into your mortgage each month to pay it off sooner, consider investing that extra money.

It’s important to do your research during the home-buying process; you can’t believe everything you hear. Rather than paying more into your mortgage each month to pay it off sooner, consider investing that extra money.