How Has the Demand for Refinancing Services in the US Evolved Over Time?

Did you know mortgage refinancing in the US reached an all-time high at the end of 2020? The sum of the principal and interest owed on mortgaged properties by December 2020 was approximately $933 billion! In contrast, the value of refinancing originations barely exceeded $100 billion in 2018. This begs the question—what factors caused the demand for refinancing services in the US to fluctuate in the last couple of decades?

Here’s a look at how and why the demand for refinancing services in the US has fluctuated since 2002.

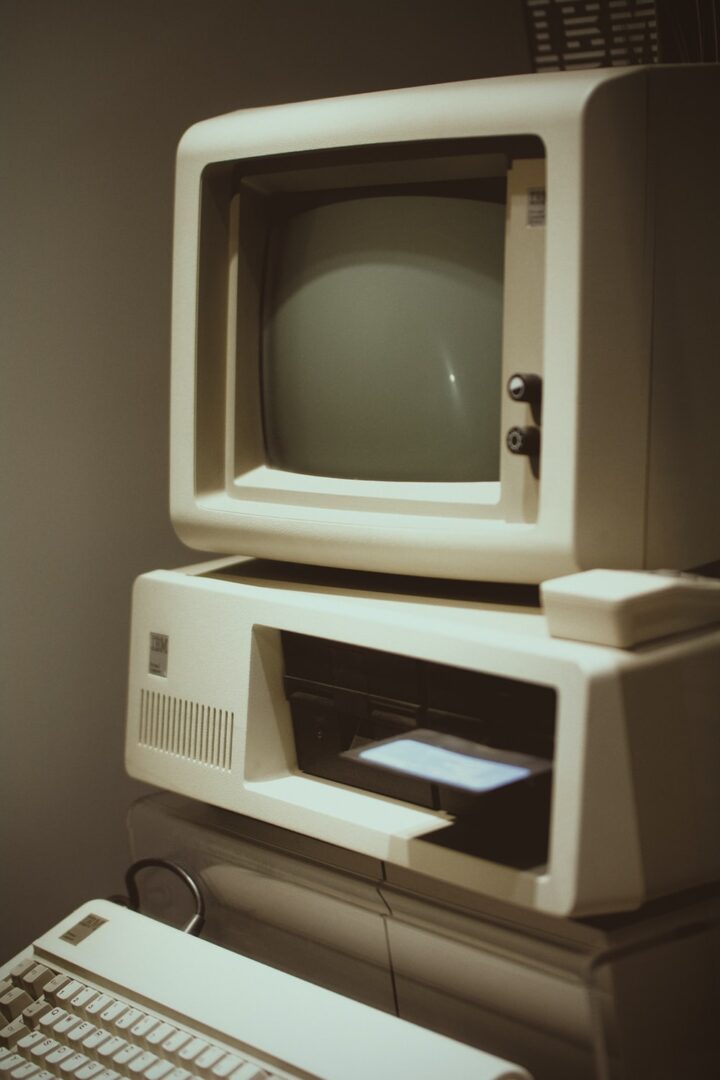

2002: Technology Powers the Demand forRefinancing Services

Imagine refinancing a mortgage and having to pay a hefty chunk of money for things like printing and filing documents. It might sound odd in today’s cloud computing-dominated world, but that’s what refinancing services were like before the turn of the 21st century!

The introduction of affordable PCs, USB storage, and shared office intranet systems made it possible for refinancing companies to generate, store, and process mortgage documents quickly. This led to a sharp decline in mortgage transaction costs, leaving customers with access to cheap refinancing services and causing the demand for mortgage refinancing to shoot up.

2010 to 2015: Refinancing Demand Drops in the Wake of the Global Financial Crisis

As technology improved between 2002 and 2010, mortgage transaction costs continued to fall. During the same period, the Federal Reserve dropped the interest rate, causing borrowers to flock to mortgage lenders to secure a lower rate on their home loans. Unfortunately, many borrowers were also granted home loans without undergoing proper background checks during this period.

In 2010, financial experts finally noticed a housing bubble caused by irresponsible mortgage lenders giving out sub-prime mortgage loans to borrowers with poor FICO scores and unstable incomes. This eventually caused the housing market to crash in 2010 and prompted the government to introduce legislation to toughen mortgage application and refinancing requirements. As a result, the demand for mortgage refinancing dropped considerably.

2015 to 2020: Interest Rate Fluctuations Cause Spikes in the Demand for Refinancing

In mid-2015, the Federal Reserve’s decision to temporarily lower the interest rate caused a surge in mortgage refinancing applications. Many borrowers swapped their old mortgages for larger ones and cashed out the difference for fear of losing out on the lower rate. In simpler words, the demand for cash-out refinancing services grew between 2015 and 2018.

It’s worth noting that homeowners extracted less equity from their homes via cash-out refinancing during the 2015 to 2018 period than they did during the Global Financial Crisis. This occurred because of tougher cash-out refinancing legislation and because households were more cautious about their mortgages after the housing market collapsed in 2010.

2020 to 2021:Refinancing Services in High Demand Among Remote Workersduring COVID-19

When the COVID-19 pandemic peaked in 2020 and 2021, schooling and working from home became the norm. It also became increasingly common for people to avoid going out to exercise, eat, or socialize with friends. This sparked a rise in the demand for home remodeling—particularly among remote workers who grew increasingly comfortable with the idea of doing as many things from home as possible.

As the demand for home gyms, classrooms, and office spaces began to rise, so did the demand for refinancing services. Borrowers began demanding better terms on mortgages like the FHA 203(k) home loan designed for those that want to finance and renovate single-family properties simultaneously.

Interestingly, numerous people still work remotely even though the worst of the COVID-19 pandemic is seemingly behind us. One major reason why is because many homeowners who opted to refinance their mortgages during the COVID-19 pandemic did it as part of a strategy to permanently work from home. Having repurposed their homes for remote work and secured a mortgage on great terms, these homeowners don’t have a solid reason to go back to how things were before the pandemic.

2022 Onwards: Refinancing Depends on Individual Circumstances

Nowadays, the demand for refinancing services has fallen due to a rise in the general mortgage rate. In the past, events like the COVID-19 pandemic and the Global Financial Crisis caused clear changes in the demand for refinancing. In contrast, the current demand for refinancing services depends on borrowers’ personal circumstances.

Experts believe the Fed will lower the interest rate by 2023 in response to low inflation and a potential recession. If this occurs, the demand for refinancing services (particularly rate and term refinancing) will increase as homeowners flock to obtain improved terms on their current mortgages.

Atlantic Home Capital Provides High-quality Refinancing Services in Fort Lauderdale

Thinking of improving the terms on your mortgage in case the Fed lowers the interest rate? Want to cash out a portion of your home’s equity to consolidate debt? Or what if you just want to pay your mortgage back early? You can do all of this by opting for Atlantic Home Capital‘s comprehensive refinancing services!

Our team’s talent, experience, and dedication to customer service have enabled us to build a reputation for being a top mortgage refinance company in Fort Lauderdale. In addition to refinancing services, we help clients apply for various mortgage loans such as FHA loans for first-time homebuyers and jumbo home loans for those interested in purchasing prime real estate. We also offer investment property loans for real estate investors and modular home financing for borrowers interested in purchasing a prefabricated property.

Eager to learn more about our refinancing services in Fort Lauderdale? If so, leave us a message on our website, and one of our mortgage consultants will get back to you ASAP!